Open Enrollment for health insurance for 2022 begins on November 1st and will run, in most states, through January 15, 2022. On the ACA exchange - www.healthcare.gov - get enrolled by December 15th to have insurance that begins on January 1st, 2022. Enrollment from December 15 - January 15 will begin on February 1st.

With the passage of the American Rescue Plan in 2021, new subsidies and financial assistance have become available to Americans across the country through the end of 2022. Those who were not eligible for subsidies when they enrolled for 2021 will likely find increased subsidies for 2022, and if they did not claim their enhanced 2021 subsidies, may receive a significant refund when they file their 2021 tax return.

Many people will find they will be able to move from a bronze level plan to a silver plan with lower deductibles. Those who qualify for a cost-sharing reduction will be able to enroll in a silver plan, and will see lower deductibles, copays, and coinsurance. (Cost-sharing reductions of CSRs usually apply to the second lowest silver tier plan.)

If you didn't qualify for subsidies before due to your income level, you likely will now. For those whose annual income was above 400% of the federal poverty level (the so-called fiscal cliff), subsidies are now be available because the limit has been lifted through the end of 2022. Remember subsidies are only available if you enroll in coverage on either healthcare.gov or, if your state has its own exchange, their website. If you don't know your state's website, go to healthcare.gov and you will be directed there.

In addition, anyone who receives unemployment insurance during 2022 will automatically be considered for the rest of the year to have an annual income of 133% of the federal poverty level, and will see their premiums reduced in many cases to zero. If you enroll in a silver tier plan, this would also include cost-sharing reductions lowering deductibles, copays, and coinsurance. This will apply for the entire year, even if a person only receives only a week of unemployment or sees their income rise to above the level to usually qualify. This will help those in states that have not expanded Medicaid to access low or no-cost health insurance this year.

Additionally, those who overestimated their income (MAGI) for 2020, will not be subject to repaying subsidies received in the 2020 tax filing reconciliation process on your tax form.

While many of these benefits have been put in place for the next two years only, we hope you will join with us as we work to have many of them extended and incorporated into the ACA in perpetuity.

To find free local help to get covered, please click here to go to the Get Covered Connector.

With the passage of the American Rescue Plan in 2021, new subsidies and financial assistance have become available to Americans across the country through the end of 2022. Those who were not eligible for subsidies when they enrolled for 2021 will likely find increased subsidies for 2022, and if they did not claim their enhanced 2021 subsidies, may receive a significant refund when they file their 2021 tax return.

Many people will find they will be able to move from a bronze level plan to a silver plan with lower deductibles. Those who qualify for a cost-sharing reduction will be able to enroll in a silver plan, and will see lower deductibles, copays, and coinsurance. (Cost-sharing reductions of CSRs usually apply to the second lowest silver tier plan.)

If you didn't qualify for subsidies before due to your income level, you likely will now. For those whose annual income was above 400% of the federal poverty level (the so-called fiscal cliff), subsidies are now be available because the limit has been lifted through the end of 2022. Remember subsidies are only available if you enroll in coverage on either healthcare.gov or, if your state has its own exchange, their website. If you don't know your state's website, go to healthcare.gov and you will be directed there.

In addition, anyone who receives unemployment insurance during 2022 will automatically be considered for the rest of the year to have an annual income of 133% of the federal poverty level, and will see their premiums reduced in many cases to zero. If you enroll in a silver tier plan, this would also include cost-sharing reductions lowering deductibles, copays, and coinsurance. This will apply for the entire year, even if a person only receives only a week of unemployment or sees their income rise to above the level to usually qualify. This will help those in states that have not expanded Medicaid to access low or no-cost health insurance this year.

Additionally, those who overestimated their income (MAGI) for 2020, will not be subject to repaying subsidies received in the 2020 tax filing reconciliation process on your tax form.

While many of these benefits have been put in place for the next two years only, we hope you will join with us as we work to have many of them extended and incorporated into the ACA in perpetuity.

To find free local help to get covered, please click here to go to the Get Covered Connector.

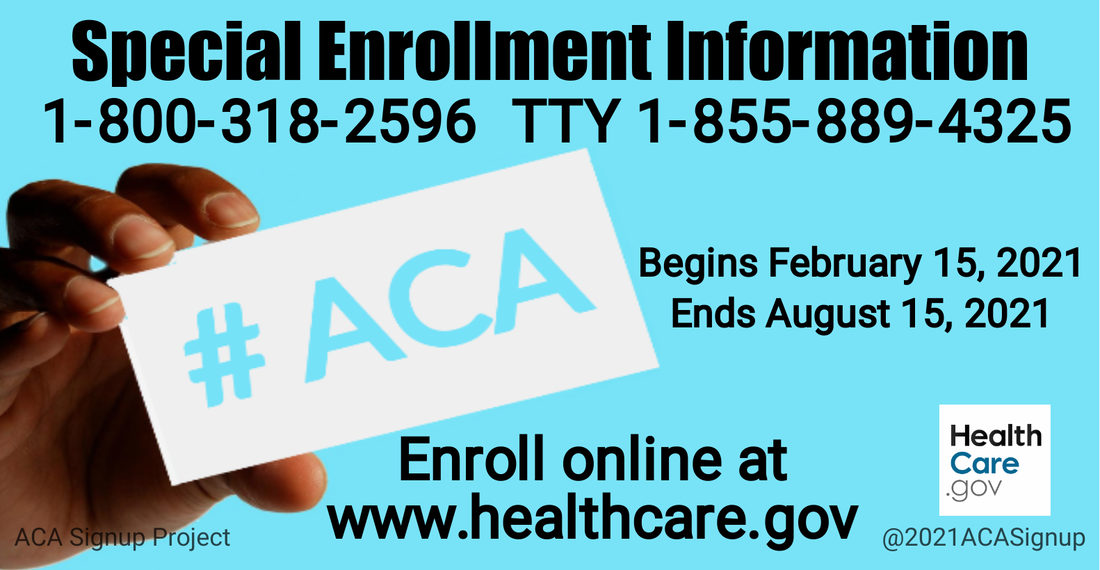

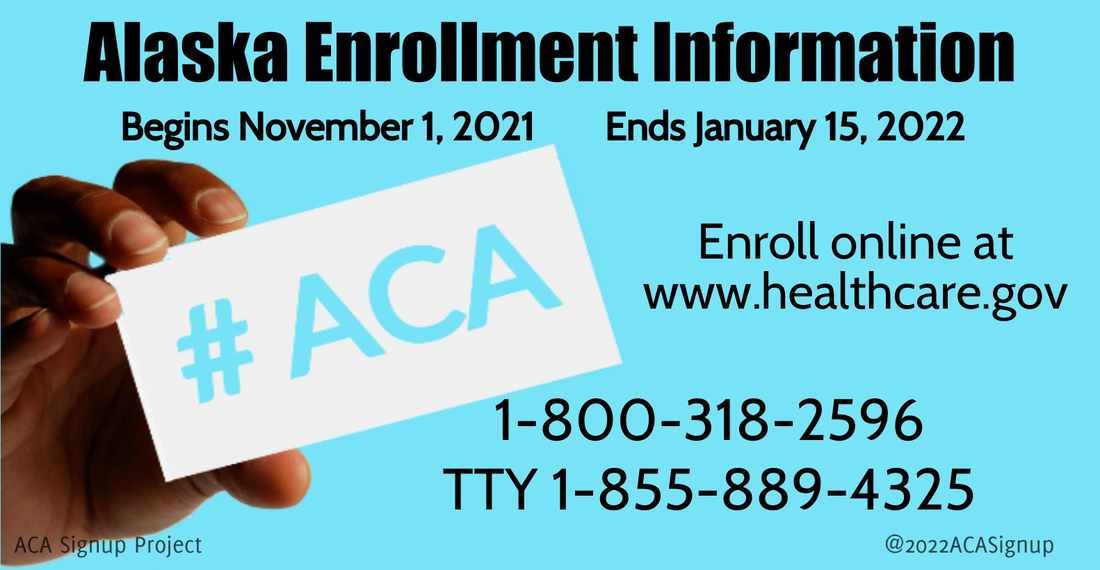

Please click on the images below to access state-specific images for 2022 Open Enrollment to help spread the word and #GetAmericaCovered. Right click on the critter images below to share those on social media with friends and family.

To quickly and easily tweet out the state-specific images with the woman's hand, click here. To quickly and easily tweet out the state-specific images with the Black hand, click here.

To quickly and easily tweet out the state-specific images with the woman's hand, click here. To quickly and easily tweet out the state-specific images with the Black hand, click here.

Need help getting enrolled? Go to the Connector! Click here to find a navigator or assister near you and make an appointment.