Change comes through action.

We each have a voice and combined we can make sure our desires for change are heard.

We each have a voice and combined we can make sure our desires for change are heard.

Stop Pre-Payment Requirements (6/2019)

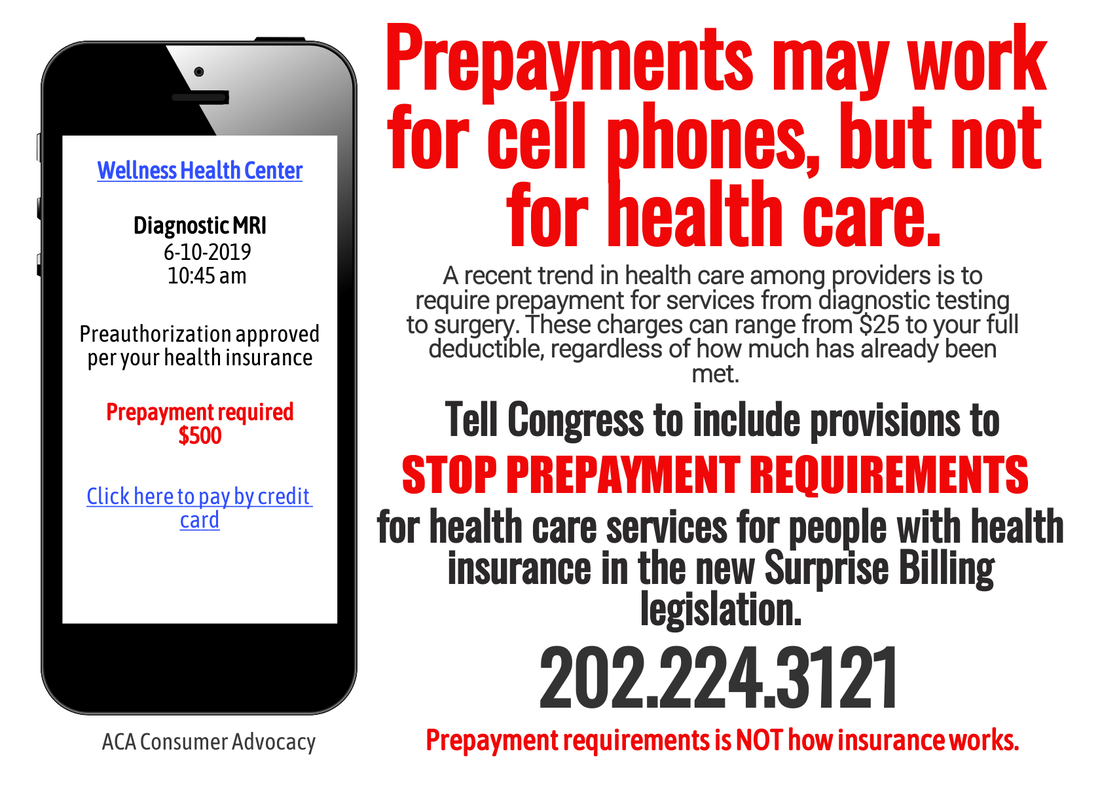

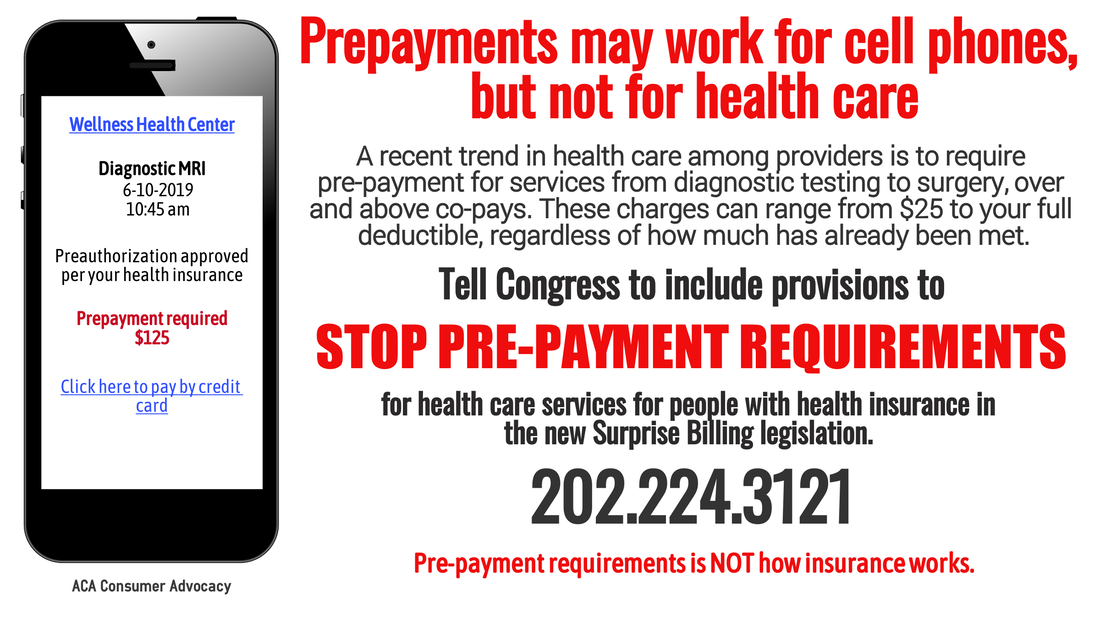

For the last couple of years, an insidious practice has become more and more common. Consumers have made appointments for tests, procedures, and surgery with the understanding that their insurance would require payments of co-pays and potentially co-insurance. However, patients have been receiving calls prior to their appointment telling them they have to make a deposit, sometimes the complete amount of their deductible, before their appointment. The providers politely offer the option of putting the entire amount on a credit card. Even if someone is within a couple of hundred dollars of meeting their deductible, providers have demanded the full amount up front, with the caveat that if there is an overpayment, the patient will receive a refund.

This is not how insurance works. Consumers pay a monthly premium for an ACA-qualified health insurance plan, either through their employer, via the ACA exchange, or off-exchange. These plans have set deductibles (the amount the consumer must pay out of pocket before the insurance starts paying part of the bills), with set co-pays (the amount the patient must pay for specific office or facility visits), and a set co-insurance (the percentage the consumer will pay after the deductible is met), as well as an out-of-pocket maximum (the amount at which the consumer no longer has to pay for medical visits on an annual basis). These are agreed to by the in-network providers who contract with these insurance companies.

At no time in the history of how health insurance in this country has worked have additional charges been required when seeing and in-network doctor or facility. This practice is causing people to delay diagnostic tests or treatment because they simply cannot afford an additional payment up front. This is the flip side of the "Surprise Billing" coin. Instead of being hit with a bill to consumers to pay for the additional unpaid balance of a bill the insurance company will not pay after care, this charge is happening up front. Surprise! You owe us more money before we even see you.

Congress is finally working on legislation to curb the practice of surprise billing, but this practice must be included in the bill.

To be clear - we are not talking about the agreed upon co-pays for seeking care. We are not referring to insurance that does not cover the sought care, like short term plans. We are not talking about providers outside the consumer's network. This is specific to qualified comprehensive ACA plans that providers have contracted with.

We are asking Congress to add provisions to stop this practice. Consumers are already paying the highest rates compared to other countries for care, for coverage, for access. This is an additional cost that has no place in our health care process.

Below are graphics to share, letter templates, letter to the editor templates, and phone scripts. It is up to us to make some noise and get this practice stopped.

This is not how insurance works. Consumers pay a monthly premium for an ACA-qualified health insurance plan, either through their employer, via the ACA exchange, or off-exchange. These plans have set deductibles (the amount the consumer must pay out of pocket before the insurance starts paying part of the bills), with set co-pays (the amount the patient must pay for specific office or facility visits), and a set co-insurance (the percentage the consumer will pay after the deductible is met), as well as an out-of-pocket maximum (the amount at which the consumer no longer has to pay for medical visits on an annual basis). These are agreed to by the in-network providers who contract with these insurance companies.

At no time in the history of how health insurance in this country has worked have additional charges been required when seeing and in-network doctor or facility. This practice is causing people to delay diagnostic tests or treatment because they simply cannot afford an additional payment up front. This is the flip side of the "Surprise Billing" coin. Instead of being hit with a bill to consumers to pay for the additional unpaid balance of a bill the insurance company will not pay after care, this charge is happening up front. Surprise! You owe us more money before we even see you.

Congress is finally working on legislation to curb the practice of surprise billing, but this practice must be included in the bill.

To be clear - we are not talking about the agreed upon co-pays for seeking care. We are not referring to insurance that does not cover the sought care, like short term plans. We are not talking about providers outside the consumer's network. This is specific to qualified comprehensive ACA plans that providers have contracted with.

We are asking Congress to add provisions to stop this practice. Consumers are already paying the highest rates compared to other countries for care, for coverage, for access. This is an additional cost that has no place in our health care process.

Below are graphics to share, letter templates, letter to the editor templates, and phone scripts. It is up to us to make some noise and get this practice stopped.

Letter to elected officials to add provisions eliminating pre-payment to current Surprise Billing legislation:

Dear _________

I am writing today in support of the current bills to stop the practice of surprise medical billing. This egregious practice is driving more and more people into financial distress, frequently following a significant health event. It is past time this country recognizes the lives and health of all of its people are more than a profit margin for health insurance companies and for-profit conglomerate provider facilities.

Along side the curtailment of surprise medical bills, I would urge you to also look into eliminating the practice that has become more and more prevalent over the last several years of providers requiring pre-payment for medical care. These prepayments have been required for everything from diagnostic imaging to life-saving surgery to child birth to medical devices for addressing birth defects.

In these cases, providers call a patient who is scheduled for a procedure or appointment and informs them they are required to pay at least their estimated portion of the bill before they are even seen. The option of putting it on a credit card is usually offered, even if the estimated portion is in the thousands of dollars. These charges can run from $75 to $250 to $10,000. If the patient cannot pay up front, there are providers who have turned patients away. Patients are delaying or simply not seeking care for medical issues because of this practice which is antithetical to how insurance is supposed to work in this country. Sometimes the patient is informed they will be refunded any overpayment - which may or may not be easy to recoup.

Other patients are informed they will have to pay the provider their entire deductible amount, regardless of how close the patient may be to satisfying that deductible amount. In the case of a patient with a $6,500 deductible who has already paid $6,300 dollars out of pocket toward that deductible, this is a completely unreasonable and inhumane burden.

This practice has been documented in several news stories over the past year. Here is one from Vox.

Simply put, this practice is the flip-side of the surprise billing coin and its practice should be eliminated along with the practice of surprise billing. Please consider adding language or an amendment to legislation limiting surprise billing that will prohibit this practice of pre-charging patients before care.

Thank you,

Dear _________

I am writing today in support of the current bills to stop the practice of surprise medical billing. This egregious practice is driving more and more people into financial distress, frequently following a significant health event. It is past time this country recognizes the lives and health of all of its people are more than a profit margin for health insurance companies and for-profit conglomerate provider facilities.

Along side the curtailment of surprise medical bills, I would urge you to also look into eliminating the practice that has become more and more prevalent over the last several years of providers requiring pre-payment for medical care. These prepayments have been required for everything from diagnostic imaging to life-saving surgery to child birth to medical devices for addressing birth defects.

In these cases, providers call a patient who is scheduled for a procedure or appointment and informs them they are required to pay at least their estimated portion of the bill before they are even seen. The option of putting it on a credit card is usually offered, even if the estimated portion is in the thousands of dollars. These charges can run from $75 to $250 to $10,000. If the patient cannot pay up front, there are providers who have turned patients away. Patients are delaying or simply not seeking care for medical issues because of this practice which is antithetical to how insurance is supposed to work in this country. Sometimes the patient is informed they will be refunded any overpayment - which may or may not be easy to recoup.

Other patients are informed they will have to pay the provider their entire deductible amount, regardless of how close the patient may be to satisfying that deductible amount. In the case of a patient with a $6,500 deductible who has already paid $6,300 dollars out of pocket toward that deductible, this is a completely unreasonable and inhumane burden.

This practice has been documented in several news stories over the past year. Here is one from Vox.

Simply put, this practice is the flip-side of the surprise billing coin and its practice should be eliminated along with the practice of surprise billing. Please consider adding language or an amendment to legislation limiting surprise billing that will prohibit this practice of pre-charging patients before care.

Thank you,

Potential phone script to support legislation precluding prepayment requirements.

Calls can be made by constituents to their elected officials. You can also ask to speak with the staff member who specializes in health care. Everyone can make calls to the different committees in the House and Senate. 202.224.3121 is the federal switchboard.

Hello. My name is and I am a constituent. I am calling to ask that provisions prohibiting the practice of health care providers requiring prepayments prior to medical care be included in the bills to stop Surprise Billing, and to ask that Rep./Sen. ________ support this legislation.

Consumers in this country are already paying significant premiums for health insurance qualified under the ACA, whether from their employers, on the ACA exchanges or off-exchange. Those plans already include agreed upon co-pays, deductibles, and co-insurance. The practice of some medical providers to require prepayments ranging from $75 to $6,500 above and beyond the contracted co-pays is making health care even more unaffordable and causing financial hardship for Americans. It is also causing some to forego medical care if they cannot pay upfront. This is not how health insurance works and it must stop. Please support adding provisions prohibiting this practice to the Senate's STOP Surprise Medical Bills Act, and the House Pallone-Walden No Surprises Act to stop surprise billing, and passing these bills. Thank you.

Calls can be made by constituents to their elected officials. You can also ask to speak with the staff member who specializes in health care. Everyone can make calls to the different committees in the House and Senate. 202.224.3121 is the federal switchboard.

Hello. My name is and I am a constituent. I am calling to ask that provisions prohibiting the practice of health care providers requiring prepayments prior to medical care be included in the bills to stop Surprise Billing, and to ask that Rep./Sen. ________ support this legislation.

Consumers in this country are already paying significant premiums for health insurance qualified under the ACA, whether from their employers, on the ACA exchanges or off-exchange. Those plans already include agreed upon co-pays, deductibles, and co-insurance. The practice of some medical providers to require prepayments ranging from $75 to $6,500 above and beyond the contracted co-pays is making health care even more unaffordable and causing financial hardship for Americans. It is also causing some to forego medical care if they cannot pay upfront. This is not how health insurance works and it must stop. Please support adding provisions prohibiting this practice to the Senate's STOP Surprise Medical Bills Act, and the House Pallone-Walden No Surprises Act to stop surprise billing, and passing these bills. Thank you.